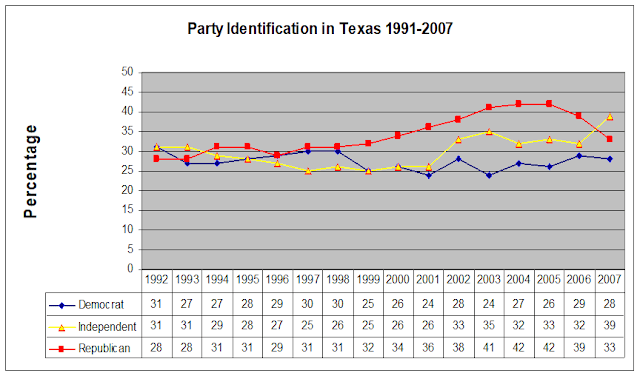

These charts illustrate my argument:

Note that Republican Party identification reached 42 percent of the registered voters in 2004 and 2005. Since then, party identification has declined for Republicans to around one-third of registered voters. Currently, party identification among Texas registered voters is approximately equally split among Republicans, Democrats, and independents.

Additional support for my contention that Democrats will win a statewide office in 2022 is the decline in the Republican Party's advantage in the straight-ticket vote since its high in 2014.

The gap was nearly identical in 2010, when Rick Perry was elected to his last term as governor, and in 2014, when Greg Abbott was elected to his first term as governor. The gap was 16.96% in 2010 and 17.87% in 2014.

The negligible gap in 2018 was the result of "Beto-mania" to some extent, but it also reflects the organizing done by Democrats at the grass-roots level. Whether my prediction is correct or not, 2022 statewide elections will prove very interesting.